Renovating My Own Home: Part 1 – Purchasing a Fixer-Upper

PURCHASING A FIXER-UPPER

The well looked after cottage from the 1970s that will become our long-term family home.

This is the story of how my partner and I are transforming a simple cottage into a considered, functional home — our own renovation project. As an interior designer, I’m approaching it with the same MARG. Studio process I use for every client, from the very first purchase decision through planning, design, and the upcoming custom home build. For my partner, this is a completely new experience, and for both of us, it’s a chance to create a home we hope to live in for decades.

The journey in three stages:

1. Purchase

2. Planning + Design

3. Build (coming in real time once construction begins this January)

Timeline

June 2024 – “My perfect” house comes on the market sparking our house hunting adventure

June – November 2024 – Financial planning, house hunting continues, multiple viewings, and offers on three properties

December 2024 – Settlement on Margaret Street house just before Christmas

January 2025 – Tenants move in on a 6-month lease; design and planning process begins

The Search

Finding the right house meant balancing multiple factors: location, price, potential, aspect, and feel. The first house I was really taken by was a house on Margaret Street way back in June 2024 - but we weren’t ready, we hadn’t done the work on our finances or discussed what we needed to know what we were even looking for. This initial beautiful 1950s brick home sparked these conversations and we were ready to begin looking shortly after. We worked out we wanted a 4 bedrooms (or 3 bedrooms and a study for my partner to work from home in), 2 bathroom home that we planned to stay in for decades.

There were a few false starts with offers on two other homes, which at the time felt disappointing. The first was a weatherboard cottage on a generous block, but the layout wasn’t quite right. To make it work, we would have had to demolish a brand-new bathroom that sat smack bang in the middle of the north-eastern side of the house, overlooking the backyard — a compromise we couldn’t justify for the price it ended up going for. The second house was an early-2000s build with a brilliant layout, but in hindsight, I didn’t love the area as much as I thought I did. I’m now glad we missed out on that one too.

When we first walked through the Margaret Street house, it wasn’t love at first sight. In fact, we put an offer on the early-2000s property first — which, as it turns out, I’m very grateful we didn’t get.

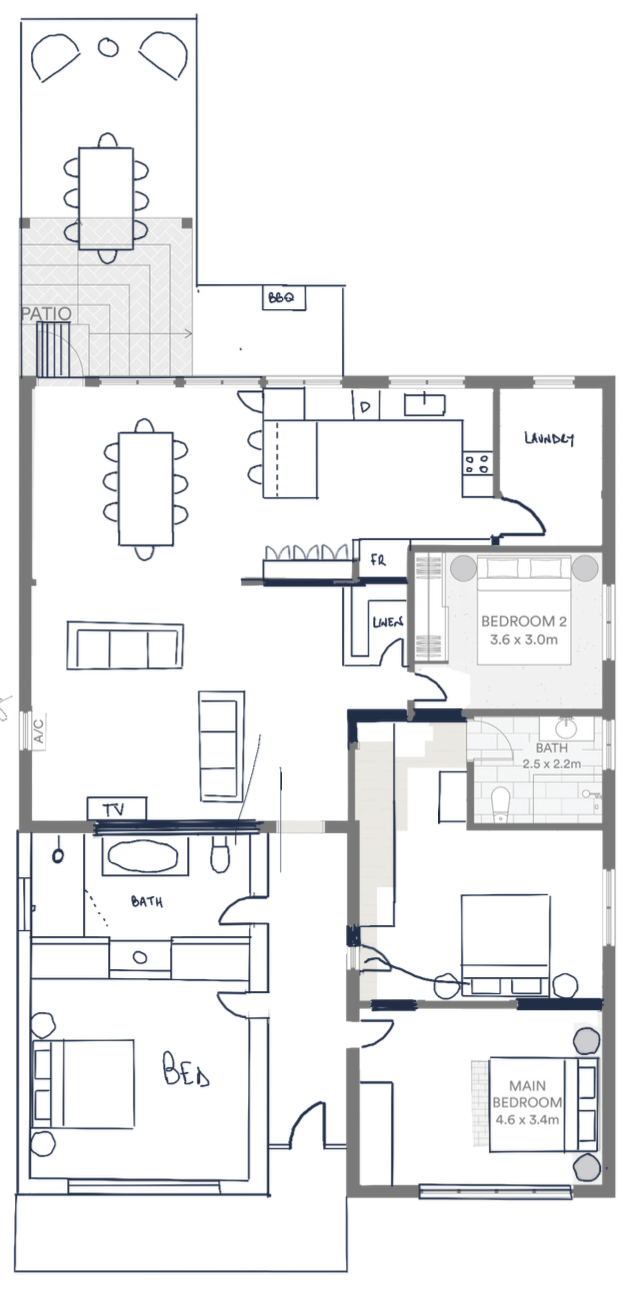

The layout of Margaret Street didn’t immediately win me over, and the amount of work required to transform it from a three-bedroom, one-bathroom house into a four-bedroom, two-bathroom home was more ambitious than we wanted. Ironic, considering what I do for a living that it was my partner who came back with a quick sketch showing how we could reconfigure the L-shaped layout, which would later become the foundation for the design and planning phase. I was sceptical at first, having only considered an internal renovation, not an extension. Still, the bones of the house and the potential in the layout started to make a lot of sense. We could achieve the exact layout and finishes we wanted, and the changes felt efficient, making the most of what was already there — for example, the existing bathroom was in good condition and could be repurposed as our ensuite.

“Sometimes it takes a fresh perspective to see the potential in a house.”

After no initial interest from other buyers, we ended up competing with a couple of others and put in an offer — which, after a little back and forth, was accepted and we settled just before Christmas 2024. Written like this, it all sounds very straightforward, but it’s worth acknowledging the many phone calls back and forth with key people who helped us understand the decisions we were making. This included builders, draftspeople, asbestos removal trades, our mortgage broker, and real estate agents. A nice little reminder to us that every property purchase has it’s own unique parameters that need to be considered and accounted for.

A very rudimentary sketch completed pre purchase to determine exactly what could be achieved.

Hurdle 1: Asbestos + a New Roof

Just before exchanging contracts, we discovered our first major renovation hurdle: the entire house was clad in asbestos. To complete the renovation as envisioned, we would need an entirely new roof — not just resheeting, but a whole new roof structure. This meant the renovation couldn’t be staged as we had first thought; it all had to be done at once. A bit of a curve ball, we adjusted our plans and moved forward, settling just before Christmas.

Discovering the asbestos cladding and a roof that requirement full replacement wasn’t initially part of our plan.

Hurdle 2: Council Approvals

From the outset, we spoke to a draftsman I’d worked with on other projects to gauge the approvals needed. Initially, it seemed a Complying Development Certificate (CDC) would suffice, which is faster and simpler than a Development Application (DA).

Once the house was purchased and we delved into planning, it became clear a DA was required due to the position of the house on the block and the neighbouring setbacks. A DA would take longer, is more involved, and more expensive. Another early reality check for the renovation project.

Hurdle 3: The Budget

We had a rough number in mind — let’s call it $x — based on prior builder conversations and my experience running full-service interior design client renovations. Feeling optimistic, we planned to complete approvals, quotes, and design work while tenants were in place for six months, aiming to start construction in late 2025 and move in by Christmas. Even I should have known better.

“Better to face financial reality early than be surprised halfway through the build.”

As detailed numbers came in, it became clear the renovation would cost our initial $x plus another 50% — a budget shock we hadn’t fully anticipated. Stressful at the time, yes — but better to face this reality while planning rather than once construction had started, with fewer options to pivot.

Seeing these numbers early gave me much more empathy for clients navigating budgeting, financing, and decision-making during their own home renovations. There’s a lot of emotion attached to building or renovating your own home — a project many people undertake only once or twice in their lifetime.

It’s easy to look back on those hurdles now and feel comfortable with how everything unfolded, but at the time there were plenty of “what have we done?” moments — particularly when it came to significant shifts in our expected spend.

Setting Up for the Next Phase

Purchasing the right house for a renovation project meant balancing potential, location, budget, and timing, and navigating a few unexpected hurdles along the way. From asbestos to council approvals and budget adjustments, this phase gave us a clear understanding of what it takes to get a project ready before any design work begins.

With the house secured, tenants in place, and the parameters of the renovation project clarified, we were ready to move into the planning and design phase — developing the vision, refining layouts, and making decisions that would turn this house into a considered, functional home we hope to enjoy for many years to come.